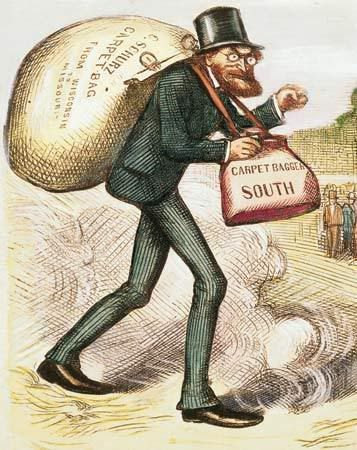

Or dare I say Carpetbaggers?

At present there are three private equity bidding groups vying to take BCE private. They are all dominated by US private equity firms, namely KKR, Cerberus and Alliance.

Henry Kravis of KKR was commenting recently on whether he prefers the term “locusts” or the older terminology of “barabarian” to describe the rapacious capital called private equity. Here’s what he had to say:

"I was disappointed with that term," said Mr. Kravis, whose firm is also the subject of a book and a film by the same name, Barbarians at the Gate, about its US$25-billion takeover of RJR Nabisco Corp. "I went from barbarian to locust," said Mr. Kravis. "I think I preferred barbarian."

Meanwhile, we get what simply amounts to hollow assurances from a wholly vested party, namely John Snow the Chairman of Cerberus, that a purchase of BCE by his consortium would not constitute “hollowing out” and so we should all go back to sleep, knowing that the three headed dog who guards hell’s gates (definition of Cerberus) has our best interests as a nation at heart by parsing the issue this way:

“Hollowing out is where you have a strategic buyer who decides we're going to have a branch office here, but we're really going to run this from wherever. That's not this case. We've made it clear the management team will stay, and that Montreal stays the headquarters.”

Given that these two gentlemen reject these descriptive terms, I have a new one for them to consider that aptly describes who they are and what they are up to. It derives from the history of their own country of origin. Except in this case, we are the failed state that is being exploited by our neighbours to the south who are being aided and abetted by Canada’s New Government and their compliant accomplices in the federal bureaucracy through favourable tax measures, many contained in the pending Budget:

CARPETBAGGERS (From Wikipedia)

"In United States history, carpetbaggers were Northerners who moved to the South during Reconstruction between 1865 and 1877. They formed a coalition with Freedmen (freed slaves), and Scalawags (Southern whites) in the Republican Party, which in turn controlled ex-Confederate states for varying periods, 1867–1877.

Carpetbaggers was coined from the carpet bags used as inexpensive luggage. It was originally a derogatory term, suggesting an exploiter who does not plan to stay. Although the term is still an insult in common usage, in histories and reference works it is now used without derogatory intent. Since 1900 the term has also been used to describe outsiders attempting to gain political office or economic advantage, especially in areas (thematically or geographically) to which they previously had no connection."

That sounds about right.

Sunday, June 17, 2007

BCE's new shareholders: Locusts or Barbarians?

Posted by

Fillibluster

at

5:53 PM

![]()

![]()

Subscribe to:

Post Comments (Atom)

2 comments:

Reported in the Globe & Mail, June 18, 2007

All about gas

Norval Scott, today at 2:18 PM EDT

“A last question to Mr. Coutu was whether the company now accepted that the government's decision to make trusts pay corporate tax was final. His answer was pretty good;

"Not as long as I live and breathe! Whether it's this government, or the next, or the one after that, the decision will be changed and the trust structure will exist. Long-term, this is a structure that has a profound benefit for Canada and Alberta that will prevail, at least in the energy sector. We will continue to fight."

“In short, the debate over trusts comes down to the following; opponents of the trust structure argue that their non-paying of corporate tax gives them an unfair advantage over conventional firms as it gives them more revenues, allowing them to pay more for acquisitions, weighting the sector in their favor and creating a large section of the industry that’s not focused on growth, but on consistent payouts to unitholders. Trust proponents say that that structure is perfectly suited for Canada’s maturing conventional oil and gas basin, creating firms designed to extract the most crude from aging oil and gas fields.

“Now that it seems almost certain that income trusts will have to pay corporate tax from 2011 under the government’s new rules, there are two main questions to ask; 1) what does this mean for the trusts, and 2) what does that mean for the rest of the industry. Those questions are complex, and unlikely to be answered fully at CAPP – not least because the grace period until 2011 means trusts have a while to make a decision whether to become a corporation, possibly move to the U.S. and become a Master Limited Partnership (essentially a U.S.-based trust), or be acquired by a public corporation or private equity.

========================================

I am more than delighted to hear Mr. Coutu’s resolve. Wonderful!

Notice the misreporting continues. Norval Scott says “their non-paying of corporate tax gives them an unfair advantage over conventional firms as it gives them more revenues.” What horsefeathers! When did an equity structure ever put even $1 of revenue in the P&L. If Mr. Scott means ‘more income for reinvestment’, well the conventional oil company is in a much better position than a trust. The typical oil company pays 0% for tax, because it drills away all of its taxable income. Who has a better deal than that? Trusts typically pay out 50% or more of their cash-flow; and thereby have only 50% or less to reinvest. Where is the unfair advantage? I’ll tell you where it is. For reasons the Globe chooses not to discuss, investors like trusts.

Notice that Mr. Scott speaks of “grace period.” There never was a grace period. It is an absorption period: four years is the time that Harper’s friends in big oil will need to absorb the energy trusts.

We may not have to wait until 2011. By law, there must be an election by 2009. But a Tory mishap is likely before then. In the meanwhile, the trust issue is wearing a hole in the heartland of conservatism.

Los Angeles business investors fund performance is not indexed to inflation. In 1980s many risk free rates round the world were in double figures. Hedge funds in those days HAD to produce much higher returns to be worth investing in. A few strategies do benefit from rising rates; for example managed futures and short biased funds have large cash balances. Put option prices drop as rates rise so some hedging costs reduce. But some hedge fund strategies are negatively exposed to rising rates, costlier credit, steeper yield curve twists and shifts and less reliable interest rate differentials between currencies.

Post a Comment